There is simply no way for them to finance additional purchases of rice by reducing meat, since they are consuming almost no meat to begin with.35 This also suggests that the best place to find Giffen behavior is among those consuming a nontrivial amount of meat. Therefore, in the next-to-last column of Table 6, we consider only households that consume at least 50 grams of meat per person in the initial period. Though the sample shrinks considerably because meat consumption is so uncommon, we do find evidence of Giffen behavior among this group, with a 1 percent increase in the price of wheat causing a 1.3 percent increase in wheat consumption. As a final robustness check, since the 80 percent threshold for the rice calorie share was a rough approximation based on a minimum-cost diet calculation, Table 5 shows the original regressions using alternative thresholds.

In both the bread and potato cases, it is possible that poor individuals exhibited Giffen behavior but the market overall did not. The concept of Giffen Good is rare and has limited practical significance in modern economies. The paradoxical relationship between price and demand is difficult to observe and measure in most cases. Giffen goods are named after him, as he was the first to describe this type of good with the paradoxical relationship between price and demand.

Mandated Wages and Market Failure

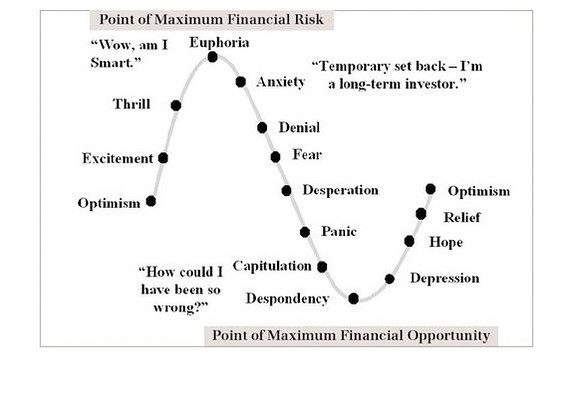

Both Giffen goods and Veblen goods are nonordinary goods that defy standard supply and demand conventions. With both Giffen and Veblen goods, a product’s demand curve is upward sloping. Income and substitution are key factors in explaining the econometrics of the upward sloping demand curve for Giffen goods as discussed.

In Economics, what is Veblen good? – The Hindu

In Economics, what is Veblen good?.

Posted: Thu, 13 Jul 2017 07:00:00 GMT [source]

The only difference between them is that, in the case of inferior goods, the consumer’s income is an important aspect that plays a vital role in the rise or fall in demand for such goods. Consumers generally pay for Giffen goods even with a rise in price, seeing as there is no substitute for these goods. For example, even if the price of bread increases, consumers will still buy it because bread is a staple food, and there are no

substitutes or alternatives. 28Though, if we do not have enough households wealthy enough to fall into the normal consumption zone, we expect that the coefficients should at least decline as staple calorie share declines. As the price of bread increases, consumers may have to reduce their consumption of other goods in order to afford the staple food, and as a result, demand for bread may increase. The income effect describes the relationship between an increase in real income and demand for a good.

E. Addressing Potential Alternative Explanations for the Results

The paper continues in Section I, where we present a discussion of the consumption behavior of the poor that motivates Giffen behavior. The term “Giffen” refers to the economist Sir Robert Giffen, who first observed the paradoxical relationship between price and demand in the context of the Irish potato famine in the late 19th century. Good is any item that adds some kind of value to the lives of people in any form. Occasionally people prefer inferior goods, even if they

receive a high income.

Where naïve intuition suggests that consumers should respond to a price increase by consuming less of the good in question, consumer theory suggests that a sophisticated consumer, mindful of the interplay between nutritional and budgetary concerns, might increase consumption. Further, the theory tells us exactly when and where we should expect to find Giffen behavior, and where we should not. To our knowledge, no other theory predicts the pattern of behavior implicit in the Giffen phenomenon, i.e., the sign of the price elasticity changing from negative to positive and back to negative as very poor consumers’ wealth increases. Thus, while economists’ failure to document Giffen behavior in the past has been interpreted as a criticism of the approach, our finding of Giffen behavior provides a type of vindication. While psychological and behavioral theories help to account for some areas of economic behavior, in the case of the Giffen phenomenon, and of the consumption behavior of the extremely poor more generally, the standard model appears to be the right one.

Giffen Good Definition: History With Examples

We also provide important new insights into the consumption behavior of poor households. These results have important implications for the design, targeting, and evaluation of programs aimed at improving nutrition among the poor. In giffen goods example in india this paper we present data from a field experiment exploring the response of poor households in China to changes in the prices of staple food items, which provide the first rigorous, empirical evidence of real-world Giffen behavior.

- It is also important to note that the difficulties facing subsidies or price controls would apply to almost any other program whose goal is to improve nutrition.

- But here, again, the heterogeneity of consumers is important to take into consideration.

- In both the bread and potato cases, it is possible that poor individuals exhibited Giffen behavior but the market overall did not.

- 34This result was unanticipated, since the northern provinces in our original paper (Jensen and Miller 2002), and our field test of the survey for the current study, revealed considerably more meat consumption in Gansu.

Calories are maximized by consuming only the staple good, and so the consumer has no choice but to respond to an increase in the price of the staple good by consuming less of it. The results are also important in light of the large literature concerned with the income elasticity of demand for calories (see John Strauss and Duncan Thomas 1995; Deaton 1997). Those policymakers who wish to increase nutrition but believe the income elasticity is small might be inclined to suggest, as alternatives to cash transfers, subsidies or price controls that directly encourage increased consumption of nutritious foods.

As the threshold varies from 70 to 90 percent, the point estimate of the elasticity for those below the threshold varies only from 0.27 to 0.47, with statistically significant coefficients in all cases. Therefore, the results point convincingly and robustly to the conclusion of Giffen behavior in Hunan. Additionally, as might be expected from the subsistence model, the coefficients broadly increase as the staple calorie share threshold declines from 0.90 to 0.75, as we are in effect excluding more and more of the least well-off, i.e., those most likely to respond to a price increase by decreasing consumption. The coefficients for each corresponding group above the threshold staple calorie share are negative for all thresholds up to 0.70; however, due in part to the smaller sample sizes in some of the cases, the effects are statistically significant only at the 10 percent level or better for the 75, 80, and 85 percent thresholds.

Substitution effect

For example, Anthony E. Bopp (1983) uses refinery utilization rates and the price of crude oil as instruments for the price of kerosene; however, both instruments likely also affect the price of substitute fuels, and are likely to be driven by other unobserved factors also affecting fuel demand, such as weather. Shmuel Baruch and Yakar Kannai (2001) use the lagged prime interest rate as an instrument for the price of a low-grade Japanese alcohol (shochu), which is likely be a poor predictor of the price of shochu, or, to the extent that it does predict the price, will likely also affect the prices of substitutes (or income—and thus demand). However, rainfall will be an invalid instrument for the price of a given food item, since it likely also affects the prices of other foods, as well as wages and income. One exception to the endogeneity concern in the search for Giffen behavior is the study by David McKenzie (2002), which uses the elimination of tortilla subsidies and price controls as a natural experiment to test for (and ultimately reject) such behavior in Mexico.

This provides a method of identifying whether a consumer is in the calorie-deprived, subsistence, or standard zone based on the share of calories received from the staple good. Consumers in the calorie-deprived zone will have a high ISCS, consumers in the standard zone will have a low ISCS, and consumers in the subsistence zone will have an intermediate ISCS. By contrast, but again consistent with the theory, the group consuming more than 80 percent of their total calories from rice (i.e., those still largely unable to consume meat), respond in the opposite direction (columns 5 and 6), with a large decline in rice consumption. Since these households consume essentially only rice, they have no choice but to respond to an increase in the price of rice by reducing demand.

Inferior Good

As incomes rise, one tends to purchase more expensive, appealing or nutritious foods. Likewise, goods and services used by poor people for which richer people have alternatives exemplify inferior goods. As a rule, used and obsolete goods (but not antiques) marketed to persons of low income as closeouts are inferior goods at the time even if they had earlier been normal goods or even luxury goods.

It is over this region that Giffen behavior arises, as the consumer responds to an increase in the price of the staple good by substituting toward the cheaper source of calories, which is still the staple good. Over this range, the consumer still trades off calories against taste, although caloric intake is given much greater importance. A consumer in the subsistence zone behaves, in effect, as if he maximizes taste subject to the constraint that calories reach a certain minimum requirement. Finally, as the consumer’s wealth decreases even further, he is unable to afford to meet his subsistence calorie needs.

- The good must either have a lack of close substitutes or the substitute good must have a higher cost than the good.

- While we are of course concerned about the inherent biases in searching over many intervals for a result, both the theory outlined above and the pattern observed in Figure 2 point to the need to examine only those who are poor, while excluding those who are too poor and not poor enough, in testing for Giffen behavior.

- We also provide important new insights into the consumption behavior of poor households.

- Likewise, goods and services used by poor people for which richer people have alternatives exemplify inferior goods.

- The total amount spent on the good must be large relative to the consumer’s budget.

24The coefficient on earned income is positive (though also small); however, since greater caloric intake may improve productivity and earnings (Thomas and Strauss 1997), especially among those with very low nutritional status, this coefficient may be biased due to endogeneity. 20While we also gathered data on food purchases and expenditures, actual daily intake is likely to be a better measure of consumption or demand. This is due to the fact that food is storable, purchases are lumpy or infrequent, and households’ recall of what they ate the day before the survey is likely to be more accurate than recall of purchases over the past month.

For both normal and inferior goods, a price increase will lead to a reduction in quantity consumed of the good due to substitute goods being relatively cheaper.[9] Consumers substitute the good in which the price has increased for either cheaper goods of the same observed quality or increase their consumption of other inferior goods. As the price of rice increases, consumers may have to reduce their consumption of other goods in order to afford the staple grain, and as a result, demand for rice may increase. A Giffen good, a concept commonly used in economics, refers to a good that people consume more as the price rises. Therefore, a Giffen good shows an upward-sloping demand curve and violates the fundamental law of demand. They have the inverse relation with price of one product and demand for its substitute.

Wheat Flour

Anecdotally, such price fluctuations, even fairly large ones, are increasingly common in developing countries.6 And while there is a large literature examining household vulnerability and responses to income shocks, there is comparably little evidence with respect to price shocks. Our analysis, by focusing on the extremely poor and by introducing exogenous price changes for staple foods, is useful for understanding this vulnerability. 5Others have argued that it is not our understanding of consumers that is flawed, but rather our understanding of markets.

The basic good offers a high level of calories at low cost, while the fancy good is preferred because of its taste but provides few calories per unit currency. A poor consumer will therefore eat a lot of bread in order to get enough calories to meet his basic needs and use whatever money he has left over to purchase meat. Now, if the price of bread increases, he can no longer afford the original bundle of foods. And if he increases his consumption of meat, he will fall below his required caloric intake. So, he must instead increase his consumption of bread (which is still the cheapest source of calories) and cut back on meat.

Thus, the heterogeneous response could mask significant gains among subsets of consumers. 31While it may seem natural to have run all the specifications above stratifying based on meat consumption rather than staple calorie share, the latter is more general and does not rely on our ability to specifically identify meat as the (only) fancy good. The survey and intervention were conducted by employees of the provincial-level agencies of the Chinese National Bureau of Statistics. The sample consisted of 100–150 households in each of 11 county seats spread throughout Hunan and Gansu provinces (Anren, Baoqing, Longshan, Pingjiang, Shimen, and Taojiang in Hunan, and Anding, Ganzhou, Kongdong, Qingzhou, and Yuzhong in Gansu), for a total of 1,300 households (650 in each province), with 3,661 individuals. It is estimated that about 90 million individuals throughout China live below the Di Bao threshold. With a rise in people’s income, the economy improves, and the demand for low cost, low-quality goods falls.

.jpeg)

.jpeg)

.jpeg)