Contents

Working capital involves financial or economic risk to a much less extent because the variations of product prices are less severe generally. Moreover, working capital gets converted into cash again and again; therefore, it is free from the risk arising out of technological changes. Working capital indicates the liquidity levels of businesses for managing day-to-day expenses and covers inventory, cash, accounts payable, accounts receivable and short-term debt. It is an indicator of the short-term financial position of an organisation and is also a measure of its overall efficiency.

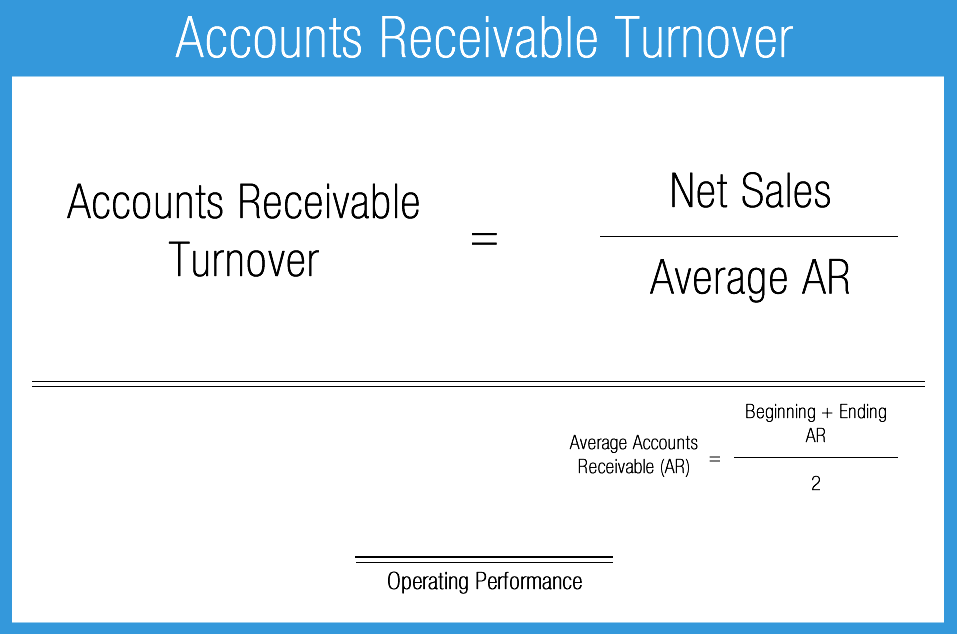

If an organization’s current property do not exceed its present liabilities, then it may have bother growing or paying again creditors, or even go bankrupt. Working capital is calculated by taking a company’s current assets and deducting current liabilities. For instance, if a company has current assets of $100,000 and current liabilities of $80,000, then its working capital would be $20,000. Common examples of current assets include cash, accounts receivable, and inventory.

- If the net working capital figure is substantially positive, it indicates that the short-term funds available from current assets are more than adequate to pay for current liabilities as they come due for payment.

- A balance sheet view classifies working capital into net and gross working capital .

- Commercial paper is a short-term, unsecured debt instrument issued by corporations typically for the financing of short-term liabilities.

Under this Inventory Management system, quantities of each stock item are reviewed periodically, which is predetermined by the management based on the production cycle. Order is placed based on stock level and probable depletion rate before the next periodic review. FIFO InventoryUnder characteristics of working capital the FIFO method of accounting inventory valuation, the goods that are purchased first are the first to be removed from the inventory account. As a result, leftover inventory at books is valued at the most recent price paid for the most recent stock of inventory.

A firm should always maintain a requisite amount of working capital for smooth and efficient functioning of its operations. The total working capital requirement is determined by a wide variety of factors. Current liabilities means those liabilities repayable within the same period, i.e., a year. In other words, current liabilities are those which are to be repaid in the ordinary course of the business within a year.

Creditworthiness applies to people, sovereign states, securities, and other entities whereby the creditors will analyze your creditworthiness before getting a new loan. And improve the cash conversion cycle, which is a critical yardstick for analyzing the working capital cycle of any business. Free Cash Flow To The FirmFCFF , or unleveled cash flow, is the cash remaining after depreciation, taxes, and other investment costs are paid from the revenue. It represents the amount of cash flow available to all the funding holders – debt holders, stockholders, preferred stockholders or bondholders. Technique of inventory management, the different stock items are ranked according to their monetary value. High-value items are closely attended to, and low-value items are devoted to minimum expenses to ensure proper control of inventories and efficient allocation.

Examples of such current assets include debtors, prepaid expenses and stock. Working capital cycle refers to the time taken to convert net current liabilities and assets into cash by a business. The shorter theworking capital cycle, the swifter the company will free up its blocked cash. Businesses strive to lower this working capital cycle to enhance liquidity in the short term. Bajaj Finserv offers working capital loans to address any deficits in working capital and ensure optimal operations. An unusual situation is for a business to be operationally sound, and yet still be able to operate with negative working capital.

A Businessman’s Guide to Working Capital Loans

Working Capital refers to a specific subset of balance sheet items and is calculated by subtracting current liabilities from current assets. Companies can forecast what their working capital will look like in the future. By forecasting sales, manufacturing, and operations, a company can guess how each of those three elements will impact current assets and liabilities.

When an organization has a optimistic internet working capital, it implies that it has enough short-time period assets to finance to pay its short-time period money owed and even put money into its development. Companies can increase their net working capital by increasing their present belongings and reducing their quick-term liabilities. Regardless of a company’s dimension or industry sector, working capital is a crucial metric in assessing the long-time period financial health of the enterprise. The stage of working capital available to an organization could be measured by evaluating its present property towards present liabilities. This tells the enterprise the quick-term, liquid assets remaining after short-time period liabilities have been paid off. Working capitalrepresents a company’s capacity to pay its present liabilities with its present belongings.

How Do You Calculate Working Capital?

The other concern is that it may be impossible to collect old accounts receivable, which might really be bad debts. To mitigate these issues, a more accurate working capital formula is to strip old inventory and old receivables from the calculation. Like liquidity management, managing short-term financing should also focus on making sure that the company possesses enough liquidity to finance short-term operations without taking on excessive risk. It refers to the short term financial arrangement made by the business units to meet uncertain changes or to meet uncertainties. A firm is always working with the expectation of some risks which may be controllable or uncontrollable.

Inventory ManagementInventory management in business refers to managing order processing, manufacturing, storage, and selling raw materials and finished goods. It ensures the right type of goods reach the right place in the right quantity at the right time and at the right price. Thus, it maintains the product availability at warehouses, retailers, and distributors. Credit SalesCredit Sales is a transaction type in which the customers/buyers are allowed to pay up for the bought item later on instead of paying at the exact time of purchase. Capital provides subsistence to the labourers while they are engaged in production. Production today is a long-drawn-out affair, and has to pass through many stages.

Tandon committee has referred to this type of working capital as Hard Core Working Capital. This type of working capital should be arranged from long-term sources of fund. It creates a sense of security and confidence in the mind of management or officials of the firm. It is considered to be the life-blood of the business and its effective and efficient management is necessary for the very survival of the business. Julia Kagan is a financial/consumer journalist and senior editor, personal finance, of Investopedia. Our mission is to provide an online platform to help students to discuss anything and everything about Economics.

Product

It varies with the variation of the purchase and sale policy; price level and the level of demand also. The portion of working capital that changes with production, sale, price etc. is called variable working capital. Working capital is constantly converted into cash which again turns into working capital. The cash is used to purchase current assets and when the goods are produced and sold out; those current assets are transformed into cash.

If current liabilities of a firm exceed current assets it is called negative working capital. In other words, working capital is said to be negative when the current assets fall short of the current liabilities. The excess of current liabilities over current assets is supposed to have been used in procuring fixed assets of the firm. Positive working capital refers to excess of current assets over current liabilities. It indicates the extent of long-term sources of funds such as equity share, preference share, retained earnings, long-term loans and debentures etc. used to finance the current assets of a business concern.

There is no doubt that securities, bonds, stocks, shares, etc., possessed by a man yield income to him. But they cannot be called capital, because they represent only titles of ownership rather than factors of production. This definition distinguishes capital from land and labour, because both land and labour are not produced factors. Land and labour are often considered as primary or original factors of production. But capital is not a primary or original factor it is a ‘produced’ factor of production. The section above is meant to describe the moving parts that make up working capital and highlights why these items are often described together as working capital.

Factors That Affect Working Capital Needs

Types of financing include a term loan, a business line of credit, or invoice financing, a form of short-term borrowing extended by a lender to its business customers based on unpaid invoices. Business credit cards, which allow you to earn rewards, can also provide access to working capital. Manufacturers with this type of seasonality often require a working capital loan to pay wages and other operating expenses during the quiet period of the fourth quarter. The loan is usually repaid by the time the company hits its busy season and no longer needs the financing.

Working Capital:

If the figure is substantially negative, then the business may not have sufficient funds available to pay for its current liabilities, and may be in danger of bankruptcy. The net working capital figure is more informative when tracked on a trend line, since this may show a gradual improvement or decline in the net amount of working capital over an extended period. If a business is experiencing low working capital levels, there are several ways to remediate the situation. However, it can be difficult to extend payments for very long without incurring the ire of suppliers.

Current liabilities are simply all debts a company owes or will owe within the next twelve months. The overarching goal of working capital is to understand whether a company will be able to cover all of these debts with the short-term assets it already has on hand. In the corporate finance world, “current” refers to a time period of one year or less. Current assets are available within 12 months; current liabilities are due within 12 months.

When buyers want to take a look at these WC numbers, they’re trying to foresee monetary difficulties that will lie just over the horizon. Working capital is the difference between a enterprise’ current belongings and current liabilities or money owed. Working capital serves as a metric for the way efficiently an organization is operating and the way financially steady it is within the https://1investing.in/ short-time period. The working capital ratio, which divides present assets by present liabilities, indicates whether a company has sufficient money circulate to cowl brief-time period debts and expenses. To calculate the working capital, examine an organization’s current belongings to its present liabilities. Working capital fails to consider the specific types of underlying accounts.

However, the company’s cash position will fall due to the long wait for customers to pay, potentially leading to the need for a bank overdraft. Interest in the overdraft may even exceed the profit arising from the additional sales, particularly if there is also an increase in the incidence of bad debts. A company can improve its working capital by increasing its current assets. Permanent working capital implies the base investment amount in all types of current resources which is respected at all times to carry on business activities. The value of current assets have been increased or decreased over a period of time. Even though, there is a need of having minimum level of current assets at all times in order to carry on the business activities effectively.

I filed the matter in court, it was later reffered for Arbitration, the tribunal has awarded me working capital and interest. That the award issued by the arbitrator is in conflict with public policy of kenya. The arbitrator find that the claimants claim for the overdraft facilities and the interest accrued on those facilities in the sum of ksh… is merited and i award the same. The sum of kshs… shall attract simple interest at the rate of …% per annum from …..until payment in full. The working capital requirements of a firm are widely influenced by the nature of business.