Content

- What Is Manufacturing Cost? – Formula, Examples, Importance, And More – Conclusion- Cost of manufacturing

- non-manufacturing Business English

- Direct Labor Manufacturing Costs

- Understanding the Costs in Product Costs

- Is Activity-Based Costing Only For Manufacturing? Cost of manufacturing

- What Is Manufacturing Cost? – Formula, Examples, Importance, And More – Recommended Reading- Manufacturing cost

- Improve Productivity- Manufacturing cost

If you can’t get enough raw materials, your production will suffer greatly, which could result in lost revenue or even bankruptcy for your company if it continues for too long. These two categories of expenses help you determine how much it costs to make your product or service after subtracting any sales tax (if applicable). You can then use this information when deciding what price point is necessary to break even on each sale while still turning a profit overall.

Since nonmanufacturing overhead costs are treated as period costs, they are not allocated to goods produced, as would be the case with factory overhead costs. Since they are not allocated to goods produced, these costs never appear in the cost of inventory on a firm’s balance sheet. Direct materials are the materials that are used in the production of the product.

What Is Manufacturing Cost? – Formula, Examples, Importance, And More – Conclusion- Cost of manufacturing

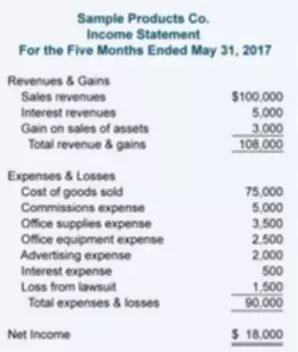

Product costs are costs necessary to manufacture a product, while period costs are non-manufacturing costs that are expensed within an accounting period. Product costs are assigned to an

inventory account on the balance sheet, initially. When finished goods are

sold, the cost of goods sold is transferred to the income statement (expensed) and

matched with the sales revenue.

Nonmanufacturing costs consist of selling expenses, including marketing and commission expenses and sales salaries and administration expenses, such as office salaries, depreciation and supplies. Manufacturing Overhead This refers to manufacturing costs other than direct material and direct labour costs. The major items included under manufacturing overhead are indirect materials, indirect labour, factory supplies, utilities depreciation, repairs and maintenance, and rent and insurance. The labor cost that can be physically and conveniently traced to a unit of finished product is called direct labor cost or touch labor cost.

non-manufacturing Business English

Activity-based costing (ABC) is a cost accounting method that attempts to assign costs to activities instead of to departments, as traditional cost accounting. The type of raw material is one of the most critical factors that affect the cost of raw materials. The type of raw material can be a factor that makes it more expensive or less expensive. New machines are expensive and require additional training for employees using them. Suppose a manufacturer is not careful about how they implement new technology. In that case, they could use it ineffectively or even waste money on systems that don’t work for them (e.g., software that doesn’t fit the company’s needs).

What are period costs and non-manufacturing costs?

What are Period Costs or Non-Manufacturing Costs? Period costs are those not related to the production of the product. Non-manufacturing costs are generally broken down into selling costs and general and administrative costs.

Another example is if you made a t-shirt and had someone help you sew on the buttons, those wages would count towards your direct labor costs. The finished product of a company may become raw material of another company. For example, cement is a finished product for manufacturers of cement and raw materials for companies involved in construction business.

Direct Labor Manufacturing Costs

Thus, management attention must be focused on both the core and the ancillary costs to control and manage them with a view to maximize profitability on long term basis. Ultimately, improving efficiency in your manufacturing process is important for ensuring that your products are of the highest quality and meet customer demands promptly. Better insights mean you can save on materials, labor, and other resources by identifying areas where improvements can be made.

You must also understand how manufacturing cost affects your pricing strategy to make informed decisions about how much money you want to make from each item sold. If your product is too big or too heavy, you might need to scale it back. You can also consider using lighter and thinner packaging materials if it makes sense for your business model.

Understanding the Costs in Product Costs

Since nonmanufacturing overhead costs are outside of the manufacturing function, these nonmanufacturing costs are immediately expensed in the accounting period in which they are incurred. That is why accountants refer to nonmanufacturing costs as period costs or period expenses. Direct labor manufacturing costs is determined by calculating the cost of employees directly responsible for https://www.bookstime.com/articles/nonmanufacturing-overhead producing the product. For example, a clothing manufacturer considers employees that dye the cloth, cut the cloth and sew the cloth into a garment as direct labor costs. However, designers and sales personnel are considered nonmanufacturing labor costs. These costs are reported on a company’s income statement below the cost of goods sold, and are usually charged to expense as incurred.

This is the relationship between direct materials, direct labor, overhead, prime cost and conversion cost. Non-manufacturing costs are costs incurred in other business costs apart from the production sector. Even though the total manufacturing cost formula is a relatively easy calculation to make, it does require a lot of input from different areas of your business.

Is Activity-Based Costing Only For Manufacturing? Cost of manufacturing

This can lead to lower costs and a more efficient manufacturing process. A company’s financial health depends on many factors, including its manufacturing costs. By understanding the total manufacturing cost formula, companies can get a clearer picture of their overall financial situation. The most apparent benefit of activity-based costing is that it provides more accurate cost information.

For example, suppose you’re unaware of the new deduction for pass-through businesses (which allows companies to deduct 20% of their income). In that case, you could miss out https://www.bookstime.com/ on thousands of dollars yearly that could go toward your current expenses or future investments. Direct materials are the raw materials that are integrated into the product.

Companies must pay more to get their products to their customers, affecting their bottom line. Suppose you have a product that takes 300 hours to make and costs $150 per hour. You want to know how much it will cost you if you make 5,000 of these products.